Objectives of this blog:

1) Plan for my retirement.

2) Journal my way to financial freedom for my family and me in Singapore.

3) Share my financial knowledge and wealth management in an easy to understand way.

My current aim is to generate a passive income of $3000.

Saturday, October 31, 2009

Dow crashing 250 points, after rallying 200 points the day before.

In the past, I definitely will not have a peace of mind when I see dow crashes. One of the reasons why I cannot have a peace of mind is because I invested too much at one go, hoping the markets will go up from the day I invested. This is a wrong thinking. Two days ago, I have added 2 lots of STI ETF in my portfolio, and I am not afraid of losing that money.

In another thought, I really hope that STI will drop below 2400 again so that I can buy some more. I have my own winning plan, so I just follow it without any fear. My advice to all the investor is to stop trying to guess the markets. Plan for your strategy and follow it strictly and fearlessly.

Friday, October 30, 2009

My Passive Income (30 Oct 09)

For my cash, I will not be targetting any Singapore Shares. I am interested in the China A Shares ETF which is going to launch soon. I will slowly invest in this ETF. I will do up another post why do I want to invest in this China ETF.

Thursday, October 29, 2009

Do you have a peace of mind after buying shares?

1) You are speculating. You buy because the shares keep going up without reasons, hoping that the shares price will go up somemore.

2) You are buying shares of the companies, without even knowing the fundamental of the companies. You buy just because of the influence of the analyst, your friends or colleagues.

3) You are using someone else money.

4) You are using money that you cannot afford to lose.

5) You invest too much money at one time, and left no more money to invest when market goes down again.

6) You are leveraging. There is a possibly to lose more than your initial investment amount.

Bought 2 lots of STI ETF on 29 Oct 09

Sunday, October 25, 2009

Why I prefered to become a investor rather than trader?

I preferred to be a investor due to the following reason:

1) I am not a TA expert for short term (I try to learn for one year, but the chances of success is still 50%). I don't think I can predict stock better than a kid who is just merely guessing.

2) I want to have a stress free mentality when it comes to buying stock. I prefer to buy and hold for good stocks for dividend rather than trading speculative stocks for short term gain. Receiving constant dividend is a source of passive income. Trading for short term gain is a type of gambling. The more stocks I buy, the more dividends I get, that's why my passive income is increasing. With this in mind, I can sleep well every night.

3) I rather spend more time to do other thing that can increase my active or passive income, than mindlessly looking at the prices of the stock jumping during trading hours. Reminder time is money. There is no need to keep track of other thing like the Dow Jones future.

4) Trading need to pay a lot of commission for buying and selling. If one trade is $30, ten trade per month already $300. That money can be better used for long term investment.

5) I have constantly saving part of my income for investment. Together with my passive income, I can buy any time when there is any correction from the market.

Lastly Sun Tzu said, "The best outcome for war is to win without fighting". I am currently following my winning plan with ease and stress free.

3rd quarter 2009 residential price index

URA has released the 3rd quarter 2009 real estate statistics. Click here to go to the URA website. I have done a snapshot of the chart on the residential price index. I draw a blue line to see whether there is any trend. Will the index goes up some more? Is now the best time to buy property?

My housing loan

If you can see at below my blog, my housing loan monthly payment is $400. My wife is actually paying a lot less than me. I manage to gain $167.60 (from interest and dividends) from my OA account. Remember the OA account currently give you 3.5% interest per year for the first $20000(cannot use for investment). That alone already give me 0.035x$20000 = $700 per year or, $58 per month. Other amount are from the dividends. I look at passive income and not capital gain or loss when it comes to investment.

I am currently paying $400-$167.60 = $232.40 per month for my flat. That will mean that I can save more OA amount to be invested next time. By following this cycle, sooner or later about 3 to 4 years, my OA passive income will eventually reach $400, and my house is free!!! See my cash flow diagram for reinvesting passive income.

You may want to find out more about whether it is better to take 15 years or 30 years housing loan here.

STI Index movement Prediction (Oct 2009 to 2011)

Saturday, October 24, 2009

Looking for new blog template

STI INDEX (Comparison between 1998-2000 and 2008-2009)

Friday, October 23, 2009

Cash Flow Diagram

Cash flow is basically what you get after deducting your expenses from your pay. Those people who have a lot of liabilities are more likely to have less cash flow or even worse, negative cash flow. Remember in my last post, I say reduce your liabilities and increase your assets is the way to be rich!!! I have put part of the money in cash flow to saving and another part into buying assets.

Cash flow is basically what you get after deducting your expenses from your pay. Those people who have a lot of liabilities are more likely to have less cash flow or even worse, negative cash flow. Remember in my last post, I say reduce your liabilities and increase your assets is the way to be rich!!! I have put part of the money in cash flow to saving and another part into buying assets.Re-investment of money received from the passive income is very important. By doing that you can compound the growth of your money . If you do it properly, you can achieve financial freedom faster.

I also draw out My Cash Flow Framework , which has more details than my cash flow diagram.

My Passive Income (23 Oct 09)

Thursday, October 22, 2009

S&P(2007 to 2009) VS NIKKEI (1990 to 1992)

China A-Share exchange-traded fund

US Dollar Index down & S&P down (21 Oct 09)

Wednesday, October 21, 2009

US Dollar Index analysis (21 Oct 09)

Tuesday, October 20, 2009

Why I use S&P500 to find out market direction?

EUR/USD 10 years chart

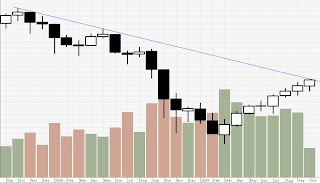

S&P 500 daily chart (Nov 08 to Oct 09)

The above S&P 500 shows that we might be hitting on the resistance line (blue line). The index keeps increasing from Sep 09 till now, but the volume keeps decreasing. So is it dued for a correction soon?

Let us looks at the weekly chart, S&P 500 is going to hit the major resistance line (blue straight line). You can see that the index is increasing with volume decreasing(see red line).

With these two charts, do you think the index will still go up without any major correction? I remembered what Sun Tzu say, if the odd of winning is low, don't bother to fight. So do you want to risk by buying up now?

Sunday, October 18, 2009

True value of S&P 500 based on dollar index (1988 - 2009)

Taiji Symbol VS S&P 500 (25 years chart)

.jpg)

The above is the 25 year chart for S&P 500

Based on my Taiji Symbol analysis:

Red portion: Body of white fish

Blue portion: Eye of white fish

Green portion: Head of white fish

Yellow portion: Tail of black fish.

So what is next? Will body of black fish come next? If that happen, the index may break 600, and that is terrible.

There is a Technical Term called "M pattern" which is showing in the chart and that is a very bearish pattern. After "M pattern" it will be followed by a "V" pattern up (Currently forming), and next will be a "A pattern" down.

Saturday, October 17, 2009

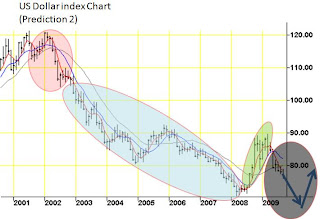

Taiji Symbol VS US Dollar Index

In the last post, I have said that Taiji Symbol is my favorite symbol. For this post, I am using Taiji Symbol to analyse US Dollar Index. US Dollar Index is the measurement of US Dollar value compared to other major currencies. It is important for non-US investors to know this index when they invest in US stock markets. Why? If their stock goes up 10%, but dollar index goes down 10%, basically they are not making money.

Red highlighted portion of both charts represents the tail of the black fish in Taiji symbol. The index started to weaken slowly at this stage.

Blue highlighted portion of both charts represents the body of the black fish in Taiji symbol. The index falls a lot at this stage.

Green highlighted portion of both charts represents the eye of the black fish in Taiji symbol. The index starts to rebound strongly at this stage.

Grey highlighted portion of both charts represents the head of the black fish in Taiji symbol. The index will again fall at this stage. It is hard to tell whether will it break new low but the fall is significant.

The two charts above show my two predictions. The first prediction shows that Dollar index will go up very soon (starting the tail of the white fish). The second prediction shows that Dollar index will still go down (continue the head of the black fish) and break new low before it will go up.

Friday, October 16, 2009

Taiji Symbol VS S&P 500 Chart (Sep 07 - Oct 09)

|  |

The above shows the S&P chart from the start of current bear market to now. For Oct 07 to May 08, signified the start of the bear market(tail of the black fish of the Taiji Symbol). For May 08 to Mar 09, signified the bear market is in the mid stage(body of the black fish). For Mar 09 to now, signified that some recovery on the way(Eye of the black fish). My guess the last stage will be a downtrend that will bring the index lower than Mar 09(Head of the black fish). This is just my own interpretation, so there is no right or wrong for it.

This symbol tells me that everything will have a slow start, accelerated growth and peak. Remember the important point is slow start, whether it is a bear or bull market. If you can identify the start points, you will be slowly be rich. For market that goes up or down too quickly, there will be a reverse in direction in no time. If you see that, it is important to clear your postion(whether long or short) before the reverse in direction.

Wednesday, October 14, 2009

GOLD VS SGD Chart. Why Gold might be a good investment in Singapore?

In my last post on gold, I mentioned that gold might provide a good hedge to the dollar. I am using SPDR GOLD SHARES for this example. Gold are traded in USD. I will combine the USD/SGD and GLD/SGD so as to see whether is gold stills a good hedge. Instead of taking all individual values from both charts, I just take values from beginning of each year. Please note that the 2010 values are estimated values from OCT 09.

I multipled USD/SGD and GLD/USD values together to get GLD/SGD. You can see that gold price keeps going up from 2005 to 2009 Oct. Even though market crash from 2008 to 2009, the value of gold in term of SGD still go up. Isn't it a safe haven investment? From $70 to $140, is about 15% compound annually.

Click here if you are interesting in how to buy gold.

Update: GOLD VS SGD (20 Nov 09)

Saturday, October 10, 2009

How to choose a house? Part 4

Second thing you must know is how much is the interest for the loan. Currently, HDB loan is fixed at 2.6%. For bank loan, the interest rate will vary from time to times. My suggestion is to take HDB loan if you are eligible. The reason is 2.6% is considered low and your monthly instalment will be fixed. If you take bank loan, it will be very hard for you to calculate the exact monthly instalment.

I have put a loan calculator on the right side of my blog. You may want to use it to check how much monthly instalment you need to pay given a total loan sum and interest rate. Of course use it at your own risk as I cannot guarantee the calculator is 100% error free every day.

How to choose a house? Part 3

Click here for part 4.

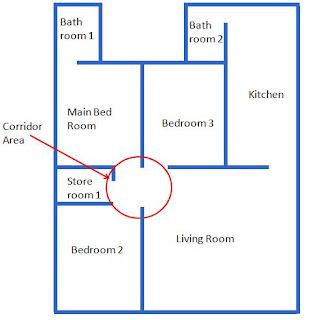

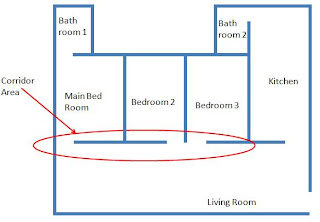

How to choose a house? Part 2

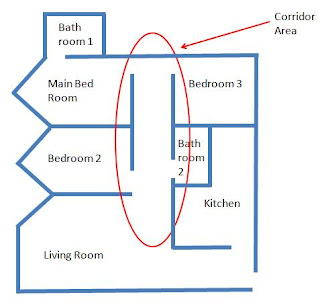

The first layout above shown (in my opinion), the best layout you can have. You can see all the bedrooms are rectangle and the living room is square. The corridor area is very small, hence you are not wasting the space. You will find it very easy to put in all your furniture.

The second layout above shown (in my opinion), is considered average. You can see all the bedrooms are rectangular. But the living room is a very long rectangle shape. You will find it hard to put your TV, sofa and your Home theatre system in the living room. Lastly, the corridor takes up a bit more space than the first one, but still consider okay. Unless your location is good, other wise, try not to get the house with this layout.

The third layout above shown (in my opinion), is not a good one (I have seen layout worse than this one). Two out of three bedrooms and living rooms are in odd shape, which make it difficult to put in the furniture. The corridor takes up a lot of space hence making your house smaller. Try not to get the house with this layout even the location is good.

Click here for part 3.

Friday, October 9, 2009

How to choose a house? Part 1

You must choose a place that is most convenience for you. If you are married, it will be better to live close to either your spouse parents' house or your parents' house. There are a lot advantages in doing it. Firstly, for any emergency, you can immediately get help. Secondly, if you have a baby, you can easily send your baby to your spouse parents' house or your parents' house for taking care. In this case, you do not need to have a car. Thirdly, you can go to their house for dinner with them every night to share the cost.

The location must be near to transportation hub like bus interchange or MRT (subway). This make travel more convenience when you go to work every day. Of course you need to pay more for such location to have this convenience.

Some calculations that I make if you need to make extra trip to transportation hub:

If additional trip is $1, one day is $2, so twenty years is $2 X 365 X 20 = $14600. Your spouse and you will pay $14600 x 2 = $29200. If include your future children, the cost will be more.

If additional trip is 20min, one day is 40min, so twenty year is 40min x 365 x 20 = 202 days.

So is it more worth to pay more for good location?

The location must be near to amenities. Just imagine you need to buy groceries and go out for a quick meal. It will be very convenience if your house is near to amenities. If these amenities are too far, it will be troublesome to carry the groceries back home especially when you need to take a bus. If you are hungry, you will feel lazy to go out to eat as the food stores are very far, and you will be ended up eating instance noodles.

Make sure you check the surrounding on possible air or noise pollution. Living in places that have air or noise pollution can greatly affect you and your emotion.

Lastly, if your house is near to transportation hub and amenities, it would be easy to sell, or sell high price with profit.

Click here for part 2.

Monday, October 5, 2009

Shares, Unit Trust, ETF

What are SHARES:

The most commonly investment instrument is shares. Shares are normally distributed by companies to raise fund for their operation or expansion. You can buy and sell shares within the trading time provided by the exchange.

You earn money when your share price goes up, and you lost money when your share price go down. You will be given dividend if the companies make money and decide to give part of the profit to the share holders.

You will be charged commission when you buy or sell your shares, usually less than 0.5% of the total cost of your shares.

UNIT TRUST:

Unit trust is a form of pooled investment where a fund manager invests funds on different shares on behalf of a group of investors.

You earn money only when your unit trust price goes up, and lose money when your unit trust price goes down. Please take note, most of the unit trust do not give out dividends.

There are sale charges when you buy unit trust. Normally is about 1 to 5% of the total cost of the unit trust you buy. There will also be management fees which normally range from 0% to 5% per annual.

Please take note, the updated price of the unit trust is done in daily basis. Normally you do not know the exact price when you buy or sell the unit trust because it will be based on the next day price.

ETF:

Exchange-traded funds hold a basket of securities like unit trust but they trade like a stock which means that they can be purchased at any time of the day.

You earn money when your ETF price goes up, and you lost money when your ETF price go down. Some ETFs will give dividends.

You will be charged commission when you buy or sell your ETF, usually less than 0.5% of the total cost of your ETF. Like unit trust, there will be management fees which normally range from 0% to 1% per annual.

Sunday, October 4, 2009

Taiji Symbol is my favorite symbol

One of my favorite symbol is the Taiji Symbol. The symbol is make up of two fish, one with white body and black eyes and another with black body and white eyes. The white body fish or yang fish represents brightness, strength, life. The black body fish or yin fish represents darkness, weakness and death. The eyes of each fish has the opposite colours as their body. This shows that within a yang there is yin, within a yin fish is yang. The symbol shows that thing move in cycle over and over again.

A lot of things can be related with this symobl, and one of it is life. The tail of the yang fish represents new life is borned. The head of the yang fish represents the strongest point of life. The tail of the yin fish represents weakness in life started to show out. The head of the yin fish represents death. The cycle continues when new life is borned.

If you apply the symbol to show the strength or weakness of a country, you can see that a country cannot be strong or weak forever. You can look into history book, there is no country that can dominate the world forever. There are times when a country is strong, and after that it will become weak.

For economy or stock market, the yang portion represents bull markets, and the yin portion represents bear markets. If you expose to stock markets, you will know that after a bull run, bear market will come eventually. After a bear run, bull markets will come eventually.

Remember the eye of the fish are of opposite colours than the body. It means there will be a strong signal telling us that the cycle is about to change. After the signal, the yang will become "yanger" intially and then slowly go toward the yin side. For the yin, it will become "yiner" intially and then slow go toward yang side.

Two of my favourite idols

|  |

They are Sun Tzu(left) and Zhu Ge Liang(right). Both are them are strategist in the past. You may google them if you interested in their stories. They are my favorite idols due to the fact that they are able to predict accurately what will happen before a war. With this abilities, they are able to counteract their enemies by surprise.

Sun Tzu said "if you know your enemies and know yourself well, you are able to win a hundred battles." What he meant is if you don't know yourself and don't know the enemies well there is not point in fighting as the result is unpredictable. He also suggested that the best outcome in a war is to win without even fighting. He did not see the point of losing a lot of man or resources just to win a war. Reducing the number of casualties is his utimate aim in every war.

Other than just a strategist, Zhu Ge Liang was also an inventor at his times. He invented an automatic car to transport grain and a special cross bow which enable multiple shoots at one time. These inventions gave him the advantage in the war, which effectively crushing his enemies.

I am trying to learn from them and apply the tactic in order to achieve my lifelong freedom aim. One thing that I have learned from Sun Tzu is to learn my strength and weakness. One thing that i have learned from Zhu Ge Liang is learn and apply new knowledge. Stick to the same method all the time will eventually lead to failure.

Saturday, October 3, 2009

Good Debt Vs Bad Debt

Bad debts are created when you need to pay out monthly instalment on non-lasting items. These items normally will depreciate in price and will be of zero value after reaching its life span. These items also do not generate income, but make you pay more in term of interest.

For example, you bought a home theatre using a monthly installation plan. After the life span of your home theatre, say 5 years later, the value will be gone to 0. This is bad debt as you need to pay interest for something that does not generate any income for you.

Good debts are created when you buy thing which can generate income for you.

For example, you buy a house and have to pay $2000 for monthly instalment. But you manage to rent out your house for $3000, you are basically earning $1000 each month. This is as good debt as your house is generating income for you. If you're thinking of doing that you may read my post "Is Condo consider a good assets?".

Friday, October 2, 2009

World Richest Man

William Gates III (Bill Gates)

Warren Buffett

Carlos Slim Helú

Lawrence Ellison

Ingvar Kamprad

Karl Albrecht

Mukesh Ambani

Lakshmi Mittal

Theo Albrecht

Amancio Ortega

Jim Walton

Alice Walton

Christy Walton

S Robson Walton

Bernard Arnault

Li Ka-shing

Michael Bloomberg

Stefan Persson

Charles Koch

David Koch

The link is here http://www.forbes.com/2009/03/11/worlds-richest-people-billionaires-2009-billionaires_land.html

Thursday, October 1, 2009

Is Condo consider a good assets?

Remember what is an assets? Assets are thing you bought that bring in money. Yes, you can collect rental from the condo but does it bring in money? In this post, I will not be saying how much you will be selling your condo in the future. Why? Because you will never know. DO NOT ASSUME that you can sell HIGHER.

I putting three loan value $600000, $800000, $1000000 and a fixed interest of 3.5%. If you are loaning $600000, you are paying $2694.26. Say maintenance cost is $300, the minimum rental you must collect is $3000. For $800,000, the minimun rental is $3900 and for $1000,000 the minimum rental is $4800. In order for your condo to be qualified as asset, you must charge higher than the minimum rental cost.

There are a lot of thing to consider if you intend to rent you condo.

Firstly, you have to find people who are willing to pay the minimum rental that you set. This may be difficult when economy is no good.

Secondly, people who rent your house may one day move out again. You have to factor in the lost in rental for certain month.

Lastly people who rent your house may accidentally damage some parts of your house. You must factor in the repair cost.

So do you think is a good assets?

Two books recommended for reading to improve your financial knowledge.

|  |

They are Robert T. Kiyosaki's book Rich Dad, Poor Dad and Adam Khoo's Profit From The Panic.

For Rich Dad, Poor Dad, it is talking about how to achieve financial independence through investing, real estate, owning businesses, and the use of finance protection tactics. If you have zero financial knowledge, this should be the first book you should read. I had read it 15 years ago and some of the ideas in the book are still relevent.

For Profit From The Panic, it is talking about why stock market crashes provide opportunities for investor to buy stocks. How to capture this opportunities and be profitable from it.

Gambling: What are the odds?

I have taken the above information from "http://www.askdrmoney.com/gambling_investing_odds.htm". It shows you the returns for different types of gambling.

As what I have expected, all returns are negative. I simply don't understand why people still gamble when the odds are against them. I still can accept when senior citizen queue up to buy 4D or TOTO as they might be lack of finance knowledge. But I saw in these recent year a lot of youngsters and even professionals have this habits too. I have a lot of questions marks on my heads. The answers I get from them is "No buy, no hope, Got buy, got hope" (directly translation from chinese). The only explanation to myself is people are normally "short-sighted". What they see is the winning price, and not what the accumlated amount that they have pay out, and not even the odds.

To admit, I gambled in the past in term of 4D and TOTO. I have lost $200 in total including $50 to buy my flat unit number during my wedding day. I have stopped gambling ever since I am exposed to finance knowledge. Of course if I went for genting holiday, I will still play the jackpot machine. But that is for pleasure and I am not expecting to win any thing.

Jack and Jill Story

Jack and Jill were providing a service to their village by fetching pails of water from the hill to the villagers. They were paid based on each pail of water fetched to the villagers.

After fetching the water for 1 year, Jill thinks of an idea. The idea is to build a pipe from the hill to the village, so that they will no longer need to go up and down the hill any more. After hearing Jill's idea, Jack shouted "What a stupid idea, how are you going to build a pipe from the hill to the village. Since you are so free, why not go and fetch a few more pails of water to earn more. Stop day dreaming and get back to work"

Jill ignored Jack comments and started to think of how to build the pipe. She spent one year to figure out on how to build a pipe from the hill to the village. She spent another one year to build the pipe. In these two years, she earned 50% less than Jack, due to the commitment on learning and building the pipe. Jack always mocked her as a crazy girl in the village during the two years.

After the completion of the pipe, Jack was still going up and down the hill to fetch water. Jill however had a better life now. All she needed to do is to turn on the pipe in the village to fill up water for the villagers. Also she can now charge less than Jack.

The villagers were very happy and satisfied with Jill's service as it is fast and efficient. More villagers are willing to get the water from Jill rather than Jack as they do not want to wait and is cheaper. Sooner or later, Jack was jobless as no villagers wanted to get water from him. He regretted what he said to Jill in the past few years.

The morale of the story:

1) Have a open heart when someone share a idea with you. Do not shoot down their ideas or mock anyone based on your ignorance. There is a saying in one of the Zen stories, "You must empty your own cup first, before other people can fill up the cup for you."

2) If you keep doing the same thing without any improvement or better services, sooner or later you will be replaced. There is no such thing as stable job now.

3) If you failed to plan now, you plan to fail in the future.

4) Building a pipe from the hill to the village is the same as building up your assets. The more assets you have, the higher your passive income will be.

Purpose of this story:

Many people are afraid of doing something different from the majority. When someone want to try out new thing, they are often mocked or discouragement by the majority due to their ignorance. My stand is do not be afraid of trying out new things.

Electricity tariffs for households to go up by 12.5% in Q4

SINGAPORE : For the quarter starting in October, electricity tariffs for households will go up by 12.5 per cent or 2.41 cents to 21.69 cents per kilowatt-hour.

SP Services said the increase is due largely to significantly higher fuel oil prices over the last three months, which rose by about 21 per cent to S$92.03 per barrel.

The company added that this brings the fuel oil price to around the level in the first quarter of this year.

This is the second quarter tariffs have gone up, after they dipped in the first two quarters of this year.

In July, tariffs went up by 7 per cent.

Starting from July, the Energy Market Authority has used a new formula for calculating tariffs - taking the average price of oil in the three months of the previous quarter, instead of the first month of the previous quarter. - CNA /ls

Based on the news from channelnewsasia.com, do you know why the oil price increases? Are you protected by hedging yet?

How to buy gold for hedging purposes?

1)Buying gold from jewellery shop.

Well, the first thing in your mind is to buy gold from jewellery shop. This type of gold might not be a good hedging as firstly you will be charge on the workmanship for the design, and secondly you will be charge GST(currently at 7% as of today). When you intend to sell it next time, you may be charge GST again. With all these, your value of gold will go down a lot.

2)Buying gold bullion.

What is gold bullion. It is commonly known as gold bar. Yes the one you always see in movies showing a safe room which a lot of gold bars inside. It also comes in term of coins. Again this types of gold may not be good for hedging too. Firstly, you will be charge GST, secondly you must find a safe place to store it. If you keep in the bank safe, you need to pay an amount every year.

3)Buying paper gold.

The third type is paper gold. Please it is not the one you buy and burn during the hungry ghost festival. Paper gold are something like shares. Like shares, you can buy it if you have a trading account. The only extra cost is commission when you buy or sell your paper gold. This commission is generally less than 1% which is much lower than GST. In SGX, there is a ETF called GLD 10US$ which is a form of paper gold. One thing to note, this ETF is traded in US$. Before you start buying (or selling), you must take the exchange rate between USD and your currency (singapore dollar).

You can also invested in paper gold using the UOB Gold Savings Account. However beware of the monthly charges.

How to become rich?

1) Money does not make your rich.(Inflation)

2) Preverse the value of money is more important than saving money. (Hedging)

3) Buying assets and reduce your liability to zero is the first step to become rich. (Cashflow)