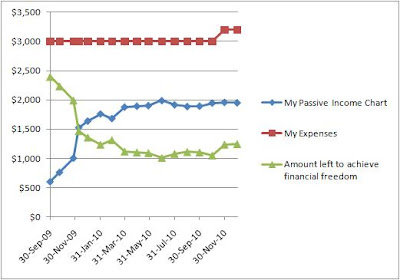

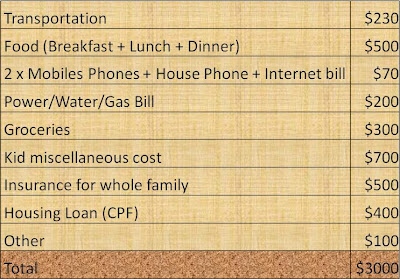

My Monthly Expenses:

For my monthly expenses, it has gone up by $200. The increase is due to my utility bills which gone up by $50, and I have catered $150 monthly for my toddler enrichment classes. I always keep my expenses as low as possible by not spending money on the things that I will not need. For this part, I will give myself an "A" grade.

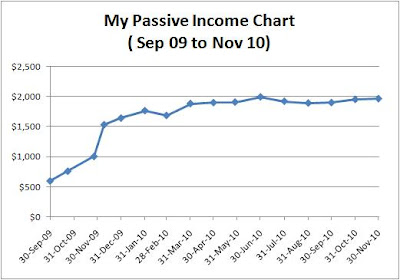

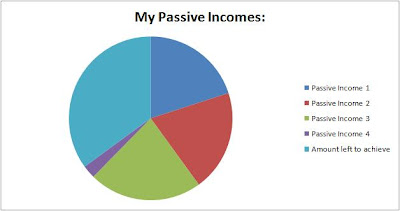

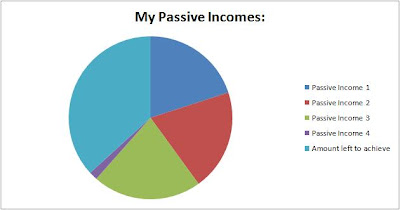

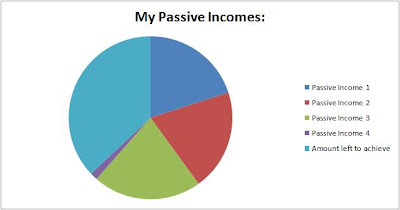

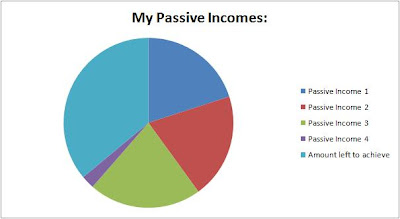

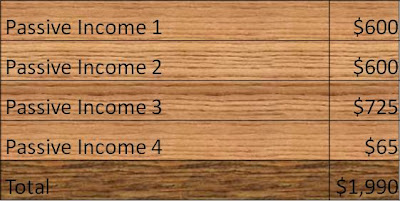

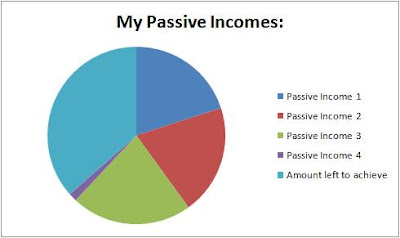

My Passive Incomes:

For my passive incomes, I have managed to increase it from $1640 (Dec 09) to $1953 (Dec 10). That is about $26 increase per month. In my New Year resolution for 2010, I have set two milestones for my journey towards financial freedom. The first one is to achieve a total passive income of $2000 by end of June 10 and the second one is to achieve a total passive income of $2400 by end of Dec 10. Though I have missed both my targets, I will still give myself a "B" grade.

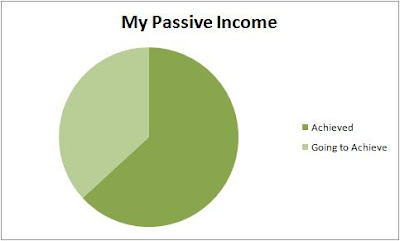

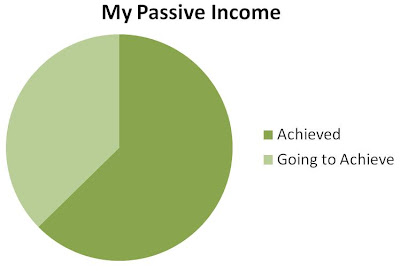

My journey towards financial freedom:

I am getting closer to achieve my financial freedom. I will need to generate an additional passive income of $1247 per month (Total Expenses of $3200 - Total Passive incomes of $1953) in order to achieve my aim.

My Assets:

These are the assets that I have. I am proud to say that I do not have any liability.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)