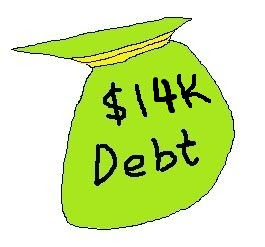

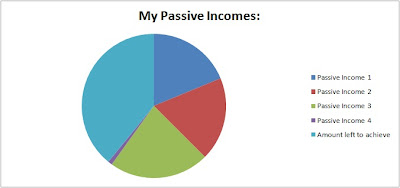

My Passive Incomes:

The above table shows the total for each of my passive incomes collected from Jan 11 to Dec 11. For my passive incomes, I have managed to collect a total of $25080 for the whole year, which is about $2090 per month. If include the realised gain of $8385 from selling some of my shares, the total extra incomes for this year will be $33465, which is about $2788 per month.

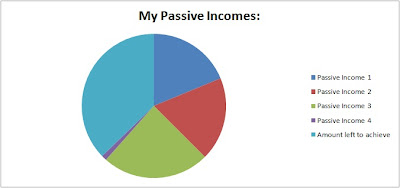

My Monthly Expenses:

The above table shows my total monthly expenses. There are no changes since the beginning of the year. I am still following my old rule to keep my expenses as low as possible by not spending money on the things that I will not need.

My debt:

As for my only outstanding debt from my housing loan, it has reduced from $33000 to $14000.

Conclusion:

This year is quite a fruitful year for me though I did not able to achieve one of my New Year resolutions of having a passive income of $2400 by end of 2011. I give myself a "B+" grade for this year performance.